An introduction

In this article, we explore the inner workings of Bitcoin mining, delving into its technical aspects and broader implications.

Bitcoin, as a digital currency, operates on a decentralized network that allows peer-to-peer transactions without the need for a central authority. This decentralized nature is one of Bitcoin’s most significant innovations, distinguishing it from traditional fiat currencies and financial systems.

At the heart of this system is Bitcoin mining. The process of Bitcoin mining is more than just a means to generate new Bitcoin; it is a fundamental component that underpins the security and integrity of the entire Bitcoin ecosystem.

Bitcoin mining ensures the security, validity, and continuity of the blockchain. Understanding Bitcoin mining is crucial for grasping how the Bitcoin network maintains its integrity and why it has become a revolutionary force in the financial world.

We will go through the concepts of decentralization, proof-of-work, and the challenges that Bitcoin mining addresses in the realm of digital finance.

Before diving into the specifics of Bitcoin mining, it is essential to understand its necessity and its central role within the Bitcoin network.

Why Bitcoin mining?

The internet has revolutionized the transfer of digital information, allowing instant, low-cost sharing of text, videos, and other data. However, this ease of duplication poses problems for transferring value. For example, if Alice wants to send €100 to Bob online, two issues arise: First, proving Alice owns the €100; and second, preventing double-spending, where both Alice and Bob end up with a copy of the €100.

Until the release of the Bitcoin Whitepaper by Satoshi Nakamoto in October 2008, we relied exclusively rely on centralized solutions like banks, PayPal, and Visa to verify and process transactions. These institutions confirm the existence of funds and deduct them upon transfer. However, this system requires trust in these institutions, that can fail or that can censor transactions. In some cases, they may even exclude people from the digital financial system (e.g. political activists) or people may even not have the opportunity open a financial account due to e.g. a lack of documentations.

Satoshi Nakamoto proposed a combination of proof-of-work and blockchain technology, addressing the double-spending problem and the need for trust in central institutions. With the launch of the Bitcoin network in 2009, it became possible for the first time to transfer value digitally in a decentralized manner without a central party involved.

Proof-of-work and the blockchain

The Bitcoin network consists of two integral parts: The blockchain and Bitcoin mining (proof-of-work).

The blockchain is a chain of blocks in which transactions are included, which in itself is not a revolutionary concept. The combination of the blockchain with Bitcoin mining is where things get interesting. Bitcoin miners play a crucial role in determining when the blockchain can be extended by another block and which chain is the correct one, all without the need for a central institution.

How does Bitcoin mining work?

Miners aim to discover a valid hash of block that meets specific criteria. Upon finding a valid hash, a miner can broadcast the block, along with the collected transactions, to the network. This new block, including the transactions of network participants, is then added to the blockchain. With each block added to the network roughly every 10 minutes the blockchain or if you want the public ledger growth in length.

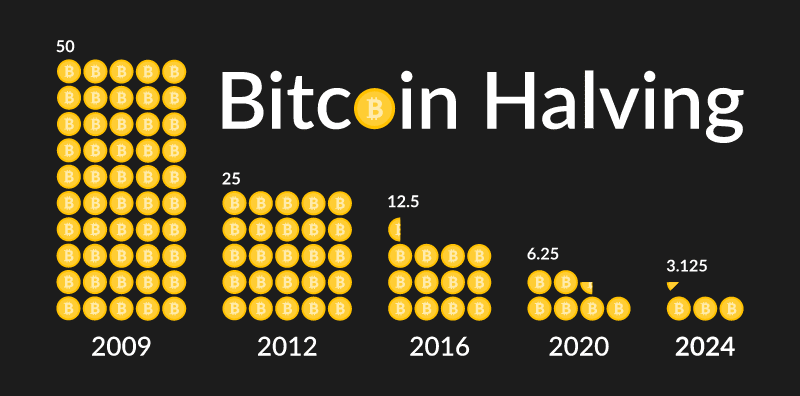

As a reward, the miner receives newly mined Bitcoin (currently 3.125 Bitcoin) and transaction fees. Every 210.000 blocks the block reward is cut in half, which means roughly every four years we have the so-called halving event. These halving cycles repeat until we asymptotically reach the maximum of 21 million Bitcoin to ever exist.

The last fraction of a Bitcoin is expected to be mined around the year 2140. Once this happens Bitcoin miners will solely rely on transaction fees from the users for revenue.

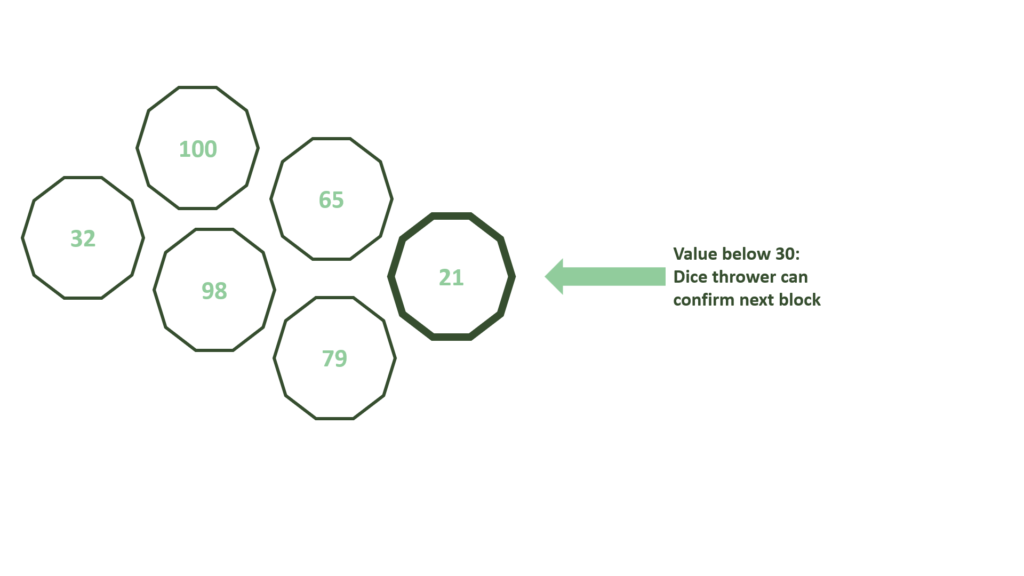

Contrary to common belief, Bitcoin miners do not solve complex mathematical problems. It is more akin to playing the lottery or throwing a dice and getting the number that fits the predetermined requirements.

For simplicity, imagine a 100-sided dice. To broadcast a block, the condition is to roll a number below 30. The person to first roll a number below 30 has the right to mine the next block.

By increasing the number of dice rolls, miners increase their chances of finding a number that fits the requirements. However, this also means more often a number that fits the requirements is being found.

The target time for finding a block within the Bitcoin network is set at 10 minutes. Adding more dice throws without any adjustments would bring the block times below 10 minutes.

Ready to transform your mining strategy?

Our innovative approach to earning Bitcoin provides optimized exposure to mining returns without the traditional operational headaches.

The Difficulty Adjustment

Here is where the difficulty adjustment comes in. Every 2016 blocks (~ every 2 weeks) the difficulty of finding a valid block is adjusted. In the dice example, if more dice are used, blocks are coming in faster. To get back to 10 minutes a difficulty adjustment will take place. Now participants, for example, have to throw a number below 20 instead of 30.

In reality, Bitcoin miners are not throwing dice. Bitcoin miners employ so called application-specific integrated circuit (ASIC) miners (machines specifically developed for Bitcoin mining) using the SHA256 hashing algorithm to find a valid hash. The miner processes a block prototype through the hash function and gets a hash in return (equivalent to one dice throw).

For the output hash there is a target range to be met. If that target range is not met the miner submits a new block prototype with minor adjustments until either the miner or another miner finds a hash that meets the current rules.

Increasing computing power, enhances the chances of finding a valid hash. The more computing power is expended to find a valid hash the more difficult it gets.

As the difficulty increases, the system adds more zeros to the beginning of the hash, reducing the range of valid hashes.

You can try out the SHA256 hashing algorithm for yourself here and see how the output changes depending on your input.

Using the input “Melanion GreenTech”, for example, provides the following hash:

702aa3f1f31ef1c82f890f851582bcf34d7780a561958e19923b638b47528a08

While replicating the Output by using the same input is possible, calculating the input from the hash is impossible. Minor changes to the input lead to a completely different hash. For instance, “melanion GreenTech” yields:

cb85cebc07597f42ed1051a2bb136e75ab7c04ee00d035aa6e9b6161355c2596

Miners cannot retroactively change a block as it alters its hash and all subsequent hashes. This prevents manipulation of Bitcoin blocks and transactions since any hash change is easily verifiable by everyone.

Conclusion

Satoshi Nakamoto’s fusion of blockchain and Bitcoin mining allows easy internet value transfer without central parties.

Bitcoin mining decentralizes the Bitcoin network by spreading transaction verification and block creation globally among miners. This decentralized approach eliminates the need for a single authority, reducing the risk of censorship and central points of failure.

Each miner competes trying to find a valid hash, ensuring that no single entity has control over the entire network. This competition fosters a secure and resilient system, maintaining the integrity and trustworthiness of Bitcoin transactions.

While this process consumes a significant amount of energy Bitcoin proponents argue that Bitcoin mining’s role in solving the double-spend problem in a decentralized manner justifies this energy expenditure alone. Thus, we cannot understate the possibility to onboard the unbanked to the global financial system or the alternative it offers to people living under authoritarian regimes or in countries with high inflation rates.

Bitcoin not only offers social benefits but also drives renewable energy transition in our economies. We will explore how Bitcoin mining and the green energy transition can work together in upcoming blog posts.

Next, we’ll explore specific site requirements for Bitcoin mining and what defines a promising location.

Further Literature:

A beginner’s guide to Bitcoin mining:

https://learnmeabitcoin.com/beginners/guide/mining

A technical guide to Bitcoin mining: