In the previous blogpost “How Hydropower Can Revolutionize Sustainable Bitcoin Mining Today” we already explored the advantages of hydropower for Bitcoin mining.

Hydropower is not only beneficial for Bitcoin mining, but Bitcoin mining can also push investments into hydropower and other renewable energy sources such as solar in, for example, Africa.

Note: The present blogpost is largely based on the report “Energy & Bitcoin in Africa: Weaving a More Distributed, Resilient Global Energy Tapestry in Africa & Beyond” by Gridless and summarizes the most important points.

The Energy divide in Africa is Stark

Nearly half of the continent’s residents—approximately 600 million people—live without electricity, as reported by the International Energy Agency. This energy scarcity hinders economic growth, limits educational opportunities, and poses significant health and environmental challenges. However, electrifying some of the areas is challenging, particularly in rural areas. Setting up a national electricity grids that connects even the most remote areas is cost-prohibitive and not an efficient use of economic resources.

Microgrids have emerged as a potential solution to this challenge. These compact energy systems present a distributed electrification strategy that aligns well with the continent’s expansive and frequently isolated terrains. Microgrids offer a scalable solution, capable of providing power to communities of varying sizes across Africa’s diverse landscapes.

However, widespread microgrid adoption in Africa needs to overcome significant obstacles. The primary challenges are rooted in the economics of energy infrastructure development in regions with low initial energy demand. This is where an unexpected ally has entered the scene: Bitcoin mining.

The Microgrid Challenge

A major challenge in establishing microgrids is the misalignment between high upfront installation costs and initially low electricity demand in newly connected areas. Building a microgrid requires substantial investment in generation equipment (often solar panels or small hydro installations), energy storage systems, distribution infrastructure, and control technologies. These costs can range from hundreds of thousands to millions of dollars.

Power demand typically starts low when a microgrid comes online in a previously unelectrified area. At first, households may only use electricity to charge phones and for light. This low initial consumption means that revenue from electricity sales is often insufficient to cover operational costs, and provide a return on the initial investment.

This creates a significant barrier to private investment in microgrid projects. Commercial financiers see a high-risk venture with a long and uncertain path to profitability. The result is a financing gap traditionally filled by grants, subsidies, or concessional financing from governments and international development organizations meaning that fewer investments are taking place as there could be.

Bitcoin Mining: A Solution to the Microgrid Challenge

Bitcoin mining offers a solution that addresses the core economic challenges hindering widespread microgrid adoption. With its unique characteristics, bitcoin mining operations can serve as the missing piece in the microgrid puzzle, speeding up the electrification and green energy transition in Africa and other places.

Here’s how Bitcoin mining transforms the economics of microgrids:

Consistent Baseline Demand:

From the beginning, Bitcoin mining facilities can utilize a substantial share of a microgrid’s power output. By that Bitcoin miners provide immediate demand for the newly generated electricity. This creates a reliable baseline demand for electricity, ensuring that the microgrid operates efficiently and generates revenue immediately (demand uncertainty risk reduced).

Flexible Consumption:

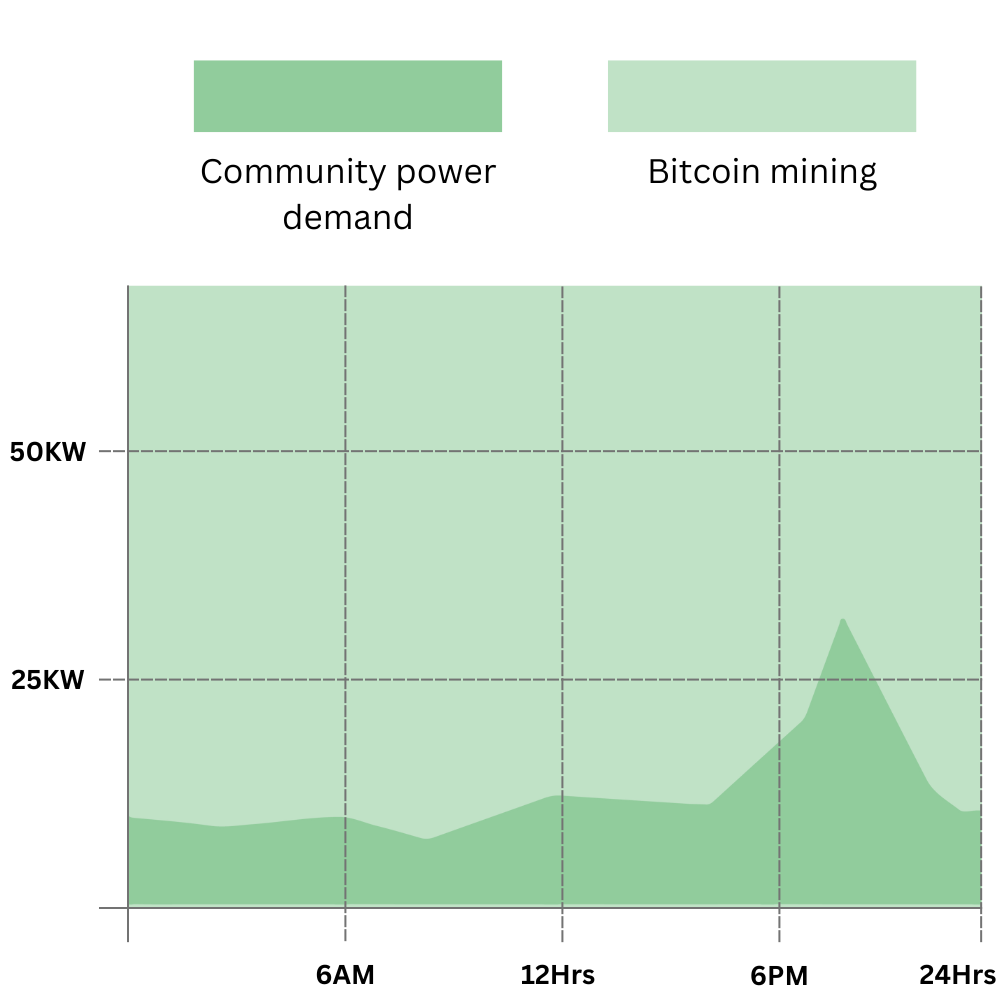

A key advantage of Bitcoin mining is its ability to adjust their energy consumption in response to supply and demand fluctuations. This flexibility allows them to act as a responsive load, increasing consumption when excess power is available and scaling back when local demand increases. This flexibility can be used for demand response intraday, but also in the medium- to long-term.

Location Agnostic:

Bitcoin can be mined anywhere with an internet connection, making it an ideal consumer for even extremely remote microgrid locations.

Immediate Revenue Stream:

The Bitcoin mined provides an immediate and globally liquid form of revenue. This is particularly valuable in regions where local currency may be volatile or where traditional banking infrastructure is limited.

Scalability with Growing Local Demand:

Bitcoin mining’s role in the microgrid ecosystem can evolve dynamically; as community power needs increase, the mining operations can scale back, freeing up capacity for local consumers.

Ready to transform your mining strategy?

Our innovative approach to earning Bitcoin provides optimized exposure to mining returns without the traditional operational headaches.

Real-World Impact – Gridless a Case Study

Several companies and research projects are exploring the potential of integrating Bitcoin mining with microgrids in Africa and other developing regions. A prominent example is Griddless that is operating five mining sites in four countries in Africa using hydro, geothermal, biomass and solar as renewable energy sources.

Their model works as follows for a hydro plant:

- They set up containerised Bitcoin mining operations that can consume the unused energy of a hydro plant’s generating capacity.

- This immediately makes the hydro plants financially viable by providing a guaranteed buyer for a significant portion of their electricity.

- The remaining capacity is made available to the local community at affordable rates. In fact, due to the additional demand, Gridless is able to provide electricity at lower rates than without the Bitcoin miners.The additional revenues further enable the company to make additional investments, such as connecting the next village via new powerlines.

- As the local community’s power needs grow, Gridless can dynamically adjust its mining operations, reducing its consumption to accommodate increased community usage.

This approach ensures the hydro plant remains financially stable while progressively serving more of the community’s energy needs. It also creates local jobs for managing and maintaining the mining equipment and can catalyse improving internet connectivity in these remote areas.

Flexible demand response of Bitcoin miners in Microgrids in Africa

Source: gridlesscompute.com

Gridless calls it a win-win-win situation:

“Bitcoin mining helps IPPs with minigrids become financially viable. Communities benefit with better grid stability, less expensive power, and more connections. We earn Bitcoin.“

The short documentary by Bitcoin Shooter illustrates this:

Challenges and Considerations

While the potential of Bitcoin mining to revolutionize microgrid financing is significant, several challenges must be addressed:

- Regulatory Uncertainty: Many African countries have unclear or restrictive policies regarding cryptocurrency mining.

- Volatility of Bitcoin: The fluctuating value of Bitcoin introduces risk into these projects.

- Environmental Concerns: It’s crucial that these projects rely on renewable energy sources to avoid exacerbating climate issues.

- Technology Access: Transporting and maintaining mining equipment in remote areas can be challenging.

- Harsh Climates: Additionally, to the remoteness the sites may be located in areas with harsher climates (e.g. high humidity, sandy etc.), which possess additional challenges to hardware maintenance.

Conclusion

Integrating Bitcoin mining with microgrids represents an innovative approach to addressing Africa’s energy access challenges. By providing a consistent baseline demand and immediate revenue stream, Bitcoin mining can make microgrid projects more financially viable, potentially accelerating electrification efforts across the continent.

While challenges remain, the potential impact is substantial. If even a tiny fraction of the global Bitcoin mining capacity were redirected to seed solar and hydro microgrids in Africa, millions could gain access to electricity.

With Bitcoin mining becoming more and more competitive and the rewards measured in Bitcoin declining with each halving event, Bitcoin miners picking up the stranded energy around microgrids may be one of the future-proof use cases in Bitcoin mining.

As this continues to be refined and tested in real-world applications like by Gridless, it could play a crucial role in bridging the energy access gap in Africa and underserved regions worldwide. It offers hope for millions awaiting their first electrical connection and demonstrates how innovative thinking can align profit motives with social and environmental benefits.

To find out more you can read the detailed report “Energy & Bitcoin in Africa: Weaving a More Distributed, Resilient Global Energy Tapestry in Africa & Beyond” by Gridless.