A Detailed Look at Performance and Timing

In the previous article, we introduced a metric to evaluate the performance of public Bitcoin miners based on the number of Bitcoins mined. Beforehand, we also introduced our innovative GreenBlock solution, outlining its advantages in comparison to traditional mining solutions.

Building on these analyses, this report evaluates the performance of our GreenBlock mining subscriptions in 2024 and in January 2025 across USD and BTC metrics.

The Bitcoin mining landscape evolved significantly in 2024, presenting both opportunities and challenges for investors seeking exposure to Bitcoin mining operations. Our GreenBlock solution offers an innovative and efficient method for acquiring Bitcoin exposure without the typical risks associated with physical mining. With our uptime guarantee, subscribers receive a consistent and optimised stream of Bitcoin mining rewards, subject to market conditions.

In this analysis, we evaluate immediate sell and HODL strategies for subscriptions initiated on the first day of each month in 2024 and January 2025. We also examine two key metrics: the amount of Bitcoin mined during the first month of each subscription and the computing power (Petahash) acquired per $100,000 investment. These metrics may aid future subscribers in determining the optimal time to subscribe to our GreenBlock solution.

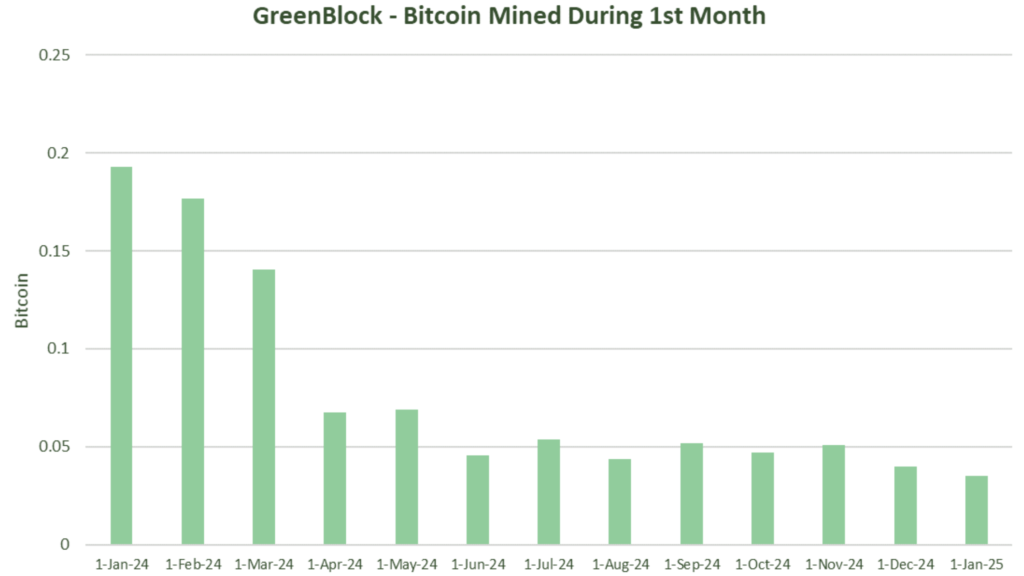

Examining the Bitcoin mined during the first month of the subscription reveals significant variations between the pre- and post-halving periods, with naturally higher returns occurring before the April halving event. Post-halving, although the absolute Bitcoin returns were lower, the month-to-month variations stabilised despite the strong rise in Bitcoin hashrate over the year. This shows that our product can reliably provide efficient mining returns to subscribers, regardless of the subscription timing.

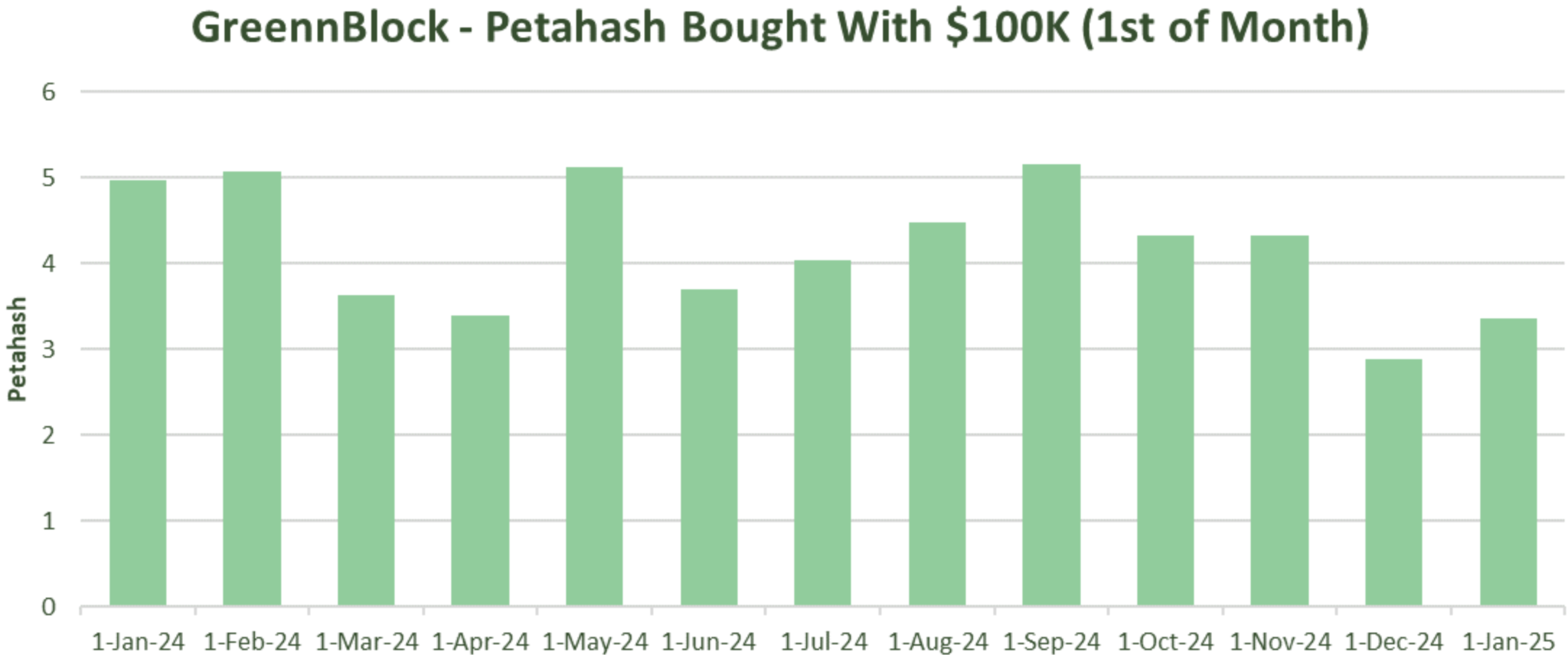

The computing power analysis reveals several months of exceptional value, with over 5 Petahash available per $100,000 invested (January, February, and September). This contrasts with periods offering less than 4 Petahash per $100,000 (February, March, April, June, December, and January 2025). The other months fall in between. This analysis can provide valuable insights for timing subscription decisions.The Bitcoin Mining Landscape and Production Analysis

The April 19th, 2024 Bitcoin halving, which reduced the block reward from 6.25 to 3.125 bitcoin, significantly impacted miners’ production.

Performance Evaluation Setting

We use a standard Greenblock subscription with the following specifications:

- Hardware Basis: Antminer S21 equivalent performance (17.5 J/TH efficiency)

- Electricity Cost: 5.5¢/kWh

- Contract Duration: 3 years

- Minimum Subscription Amount: $100,000

- 90% uptime guarantee

Similar to the previous article, we calculate the returns based on a subscription starting on the 1st of each month. The S21 was released in January 2024, which is when we will begin our analysis. The following numbers are net numbers after costs, representing the Bitcoin the licensee received after factoring in all costs.

Ready to transform your mining strategy?

Our innovative approach to earning Bitcoin provides optimized exposure to mining returns without the traditional operational headaches.

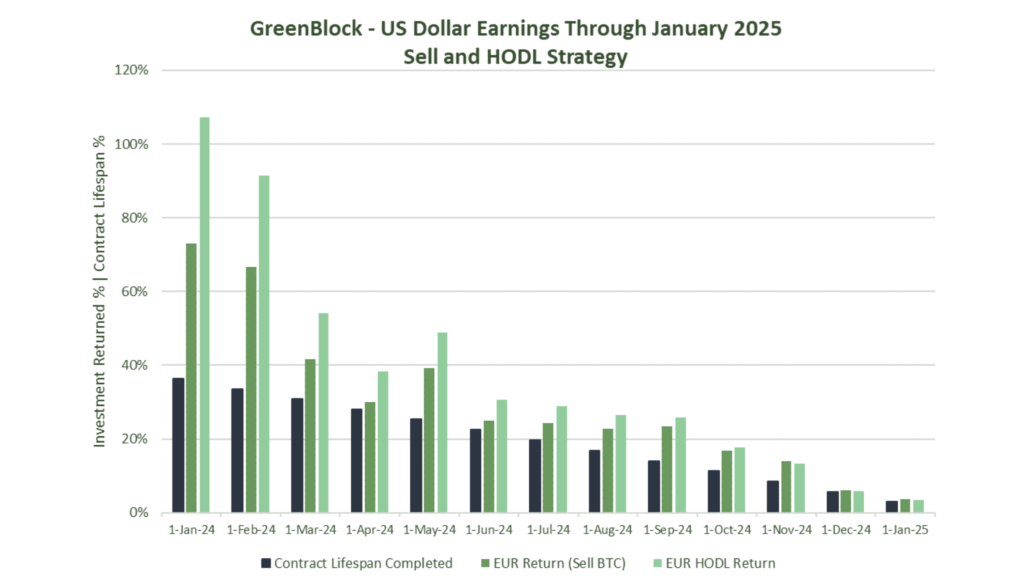

GreenBlock Performance US Dollar Sell vs HODL Strategy

As a GreenBlock subscriber, you can follow two main strategies. Subscribers can either sell mined Bitcoin immediately upon receipt (Sell strategy) or hold their assets for a longer period (HODL strategy), or you may opt to use a combination of the two strategies. Both strategies have their advantages. Historical data shows that miners have benefited from immediate selling during price peaks but have also reaped rewards from holding through bull market cycles.

While the first strategy allows you to generate monthly cash flow, the second strategy enables you to capitalise on an uptrend during a bull run but carries the risk of losing capital in a bear market. Depending on your time horizon and perspective on Bitcoin in both the short and long term, either strategy or a combination of both may be the right fit for you.

For simplicity, we will only consider the two strategies separately in this discussion. We do not examine, for instance, a strategy that involves partially selling your mining rewards or attempting to time the market.

The following chart (Chart 1) illustrates the performance of Bitcoin holdings in US dollars using a sell strategy compared to a HODL strategy. For reference, we have also included a bar indicating the percentage of each subscription completed.

Graph 1: GreenBlock Performance in US Dollar, Contract Started 1st of the Month

Suppose you want to accumulate Bitcoin over time with our solution. In that case, you can benefit from Bitcoin’s price trending up over time. This means you are following a strategy of keeping your Bitcoin for the medium to long term (HODL strategy).

A contract signed in January 2024, following a HODL strategy, has already returned more than 100% of the initial US dollar amount invested, yielding a profit of 7% (calculations based on the price on 1st February 2025). However, the contract is only 36% complete at the time of writing, meaning that the subscriber can still benefit from the subscription and Bitcoin mining rewards for nearly another two years.

Using the same strategy, the investment made on February 1st is nearly profitable. The subscriber has already recouped 92% of the initial capital invested in US dollars.

If you view Bitcoin purely as an investment or anticipate that its price will decline in the near term, you may sell your Bitcoin immediately upon receipt.

Although you would not have recovered your initial investment by selling your mining rewards upon receipt at the beginning of each month, you have already recouped 73% of your initial capital invested on the January 1st, 2024 subscription, significantly outpacing the contract, which is only 36% complete.

Upon examining the other months, all contracts indicate that US dollar returns are outpacing the duration of the contracts for both the sell and HODL strategies. By projecting this trend forward, all subscriptions are expected to generate a positive return throughout the life of the contract. The exceptions are December 2024 and January 2025. In these months, no significant difference can be observed between the percentage of the contract completed and the HODL and sell strategies. For January, the sell strategy is currently slightly ahead of the HODL strategy. However, this is due to a rather short-term perspective and the fact that the Bitcoin price has declined slightly since then.

When is a good time to subscribe to the GreenBlock Solution?

As a potential GreenBlock Solution subscriber, you may be wondering when the best time to subscribe to our solution is. Does timing really matter? In the following discussion, we will compare the returns from Bitcoin mining and the computing power obtained through a subscription for each month.

Let us first examine the Bitcoin mining returns during the first month of each subscription. The data clearly indicates a distinction between the pre- and post-halving periods in 2024. Pre-halving subscriptions naturally generated higher Bitcoin returns. However, what stands out is the stability observed in the post-halving phase.

Despite the network’s hashrate increasing significantly throughout 2024, our post-halving returns remained remarkably consistent. Yes, depending on the month you subscribed, you may have received more or less Bitcoin during the first month, but the overall fluctuations are not as substantial in absolute terms as they were pre-halving.

One issue with solely examining the Bitcoin mined is that it depends not only on the hashrate purchased with our subscription but also on the difficulty of the Bitcoin network, which is beyond our control.

Ready to transform your mining strategy?

Our innovative approach to earning Bitcoin provides optimized exposure to mining returns without the traditional operational headaches.

Graph 2: Bitcoin Mined During 1st Month of Subscription

To gain a clearer perspective, examining the computing power that each subscription would have bought can provide a more accurate understanding of how our product’s price has evolved—specifically, the amount of Petahash that a $100k subscription acquired at the start of each month.

Graph 3: Petahash Bought with $100k

Although the Petahash chart resembles the Bitcoin mined chart, with some variation in the Petahash acquired for $100k, the halving effect is much less evident, if at all visible. Throughout the year, we observed several very positive months in which subscribers received around or over 5 Petahash for their $100k investment (January, February, and September), contrasting with periods when $100k purchased less than 4 Petahash (March, April, June, December 2024, and January 2025). The remaining months are in between.

This historical data provides context for understanding how computing power per $100k investment has fluctuated over time.

Some potential subscribers may choose to monitor the Petahash/$100k metric and consider subscribing based on historical data. However, timing is not everything. Others seeking immediate exposure to Bitcoin mining may prefer to enter at current rates instead of trying to time the market.

Conclusion

The GreenBlock mining subscriptions from the past year showcase robust performance in both HODL and immediate-sell strategies.

The impact of the April halving event is evident in the Bitcoin mining data, revealing significant differences in monthly Bitcoin returns before and after the event. However, post-halving returns have demonstrated remarkable stability among the subscriptions, despite the considerable increase in network hashrate throughout the year. This stability emphasises the resilience of our GreenBlock solution in adapting to changing network conditions.

Regarding realised returns, our January 2024 subscription highlights the solution’s potential, with HODL strategy returns exceeding 100% of the initial investment and yielding a 7% profit while only 36% into the contract duration. The immediate-sell strategy has also performed well, returning 73% of the initial capital for January subscribers.

Overall, all subscriptions have provided a higher return on capital in percentage terms for both selling and HODL strategies, with December 2024 and January of this year being the exceptions (contract, HODL, and sell strategies currently being roughly on par). This suggests that if the trend continues, these subscriptions are expected to yield more capital than the initial investment.

The data underscores our product’s attractiveness to investors seeking significant and reliable returns from Bitcoin mining.

Finally, the analysis of computing power per investment offers valuable insights for timing subscriptions. Significant peaks were observed in January, February, and September, when $100k secured around or over 5 Petahash of computing power. In contrast, February, March, April, June, and December, as well as January of this year, experienced a decline in this metric, dropping below 4 Petahash. Although achieving perfect market timing may be challenging, investors could consider leveraging this historical data to identify strategic entry points for our product.

Ready to transform your mining strategy?

Our innovative approach to earning Bitcoin provides optimized exposure to mining returns without the traditional operational headaches.

Disclaimers

Past behaviour does not guarantee future results. The analysis presented in this document is based on historical data and projections that may not accurately predict future outcomes. Bitcoin mining and investment involve substantial risk of loss and are not suitable for all investors. The value of Bitcoin can be highly volatile, and investors should carefully consider their objectives, risk tolerance, and ability to bear losses before subscribing.

Mining returns are subject to numerous factors beyond our control, including but not limited to: changes in Bitcoin network difficulty, hardware efficiency, Bitcoin market prices, regulatory changes, and technological developments. Projected returns are estimates only and may differ materially from actual results.

This document is for informational purposes only and should not be considered as investment advice or a recommendation to buy, sell, or hold any investment. Investors should conduct their own research and consult with qualified financial advisors before making investment decisions.

Tax implications of mining operations and cryptocurrency transactions vary by jurisdiction. Investors should seek professional tax advice for their specific situation.