After years of heated debate regarding Bitcoin’s environmental impact, a new report on Bitcoin mining and the environment has been released – a report that will help change the narrative.

Bitcoin’s environmental impact has been the subject of considerable debate, often fueled by outdated or incomplete data. The decentralized and global nature of Bitcoin mining makes it difficult to obtain reliable, granular insights into the sector’s true energy mix, emissions, and operational practices. As a result, public narratives have frequently lagged behind reality, with critics warning of runaway fossil fuel use and supporters touting a rapid transition to sustainability.

Now, the Cambridge Digital Mining Industry Report (April 2025) delivers a comprehensive, data-driven assessment. Drawing on direct survey responses from 49 mining firms – representing nearly half (48%) of the global Bitcoin network’s hashrate – this academic study provides not just new numbers, but independent validation of what many in the industry have already been reporting:

Bitcoin mining’s environmental profile is improving at a remarkable pace.

Why This Report Matters

While industry-driven models like the BEEST model have reported similar results for quite some time (putting the sustainable energy share at 56%), independent confirmation from Cambridge lends significant credibility to these findings. Amid ongoing skepticism between industry and researchers, this report builds trust by independently verifying that Bitcoin mining is already much greener than often assumed and continues to decarbonize.

The Cambridge report’s results confirm that these industry estimates are not wishful thinking, but a fair reflection of the sector’s real-world energy profile.

This is significant not only for Bitcoin’s reputation but also for policymakers, investors, and the broader public seeking evidence-based insights into Bitcoin and sustainability.

By surveying firms that collectively account for 48% of the network’s computational power, the report provides a uniquely detailed and timely snapshot of the sector’s energy use, emissions, operational challenges, and future outlook.

Ready to transform your mining strategy?

Our innovative approach to earning Bitcoin provides optimized exposure to mining returns without the traditional operational headaches.

Key Findings: Academic Validation of Industry’s Green Estimates

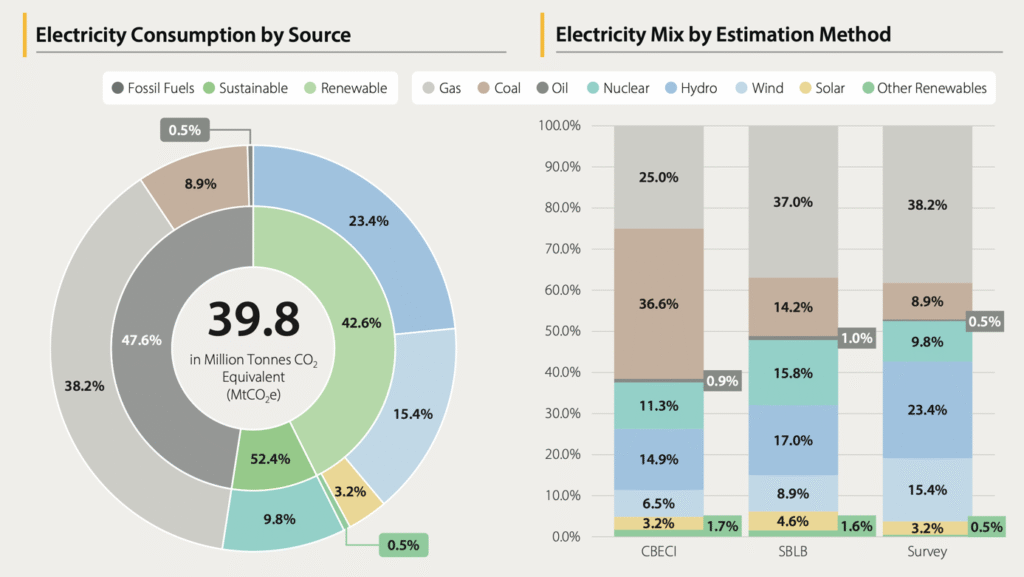

The headline finding: 52.4% of Bitcoin miners’ electricity now comes from sustainable sources.

This includes:

- Renewables:6% (Hydropower 23.4%, Wind 15.4%, Solar 3.2%, Other renewables 0.5%)

- Nuclear:8%

This marks a substantial upward adjustment over previous Cambridge Bitcoin Electricity Consumption Index (CBECI) estimates, which put sustainable energy use at just 37.6%, significantly underestimating the sustainable energy share. That jump places Bitcoin mining ahead of many traditional industries in decarbonization pace.

Fossil Fuel Reality Check

The report challenges the narrative that Bitcoin mining is dominated by coal or other high-emission sources. In reality:

- Natural gas:2% of the mix

- Coal:9%

- Oil:5%

- Fossil fuels as a whole:6% – now less than half of the total energy mix

This is a dramatic shift from previous years and underscores the sector’s ongoing transition.

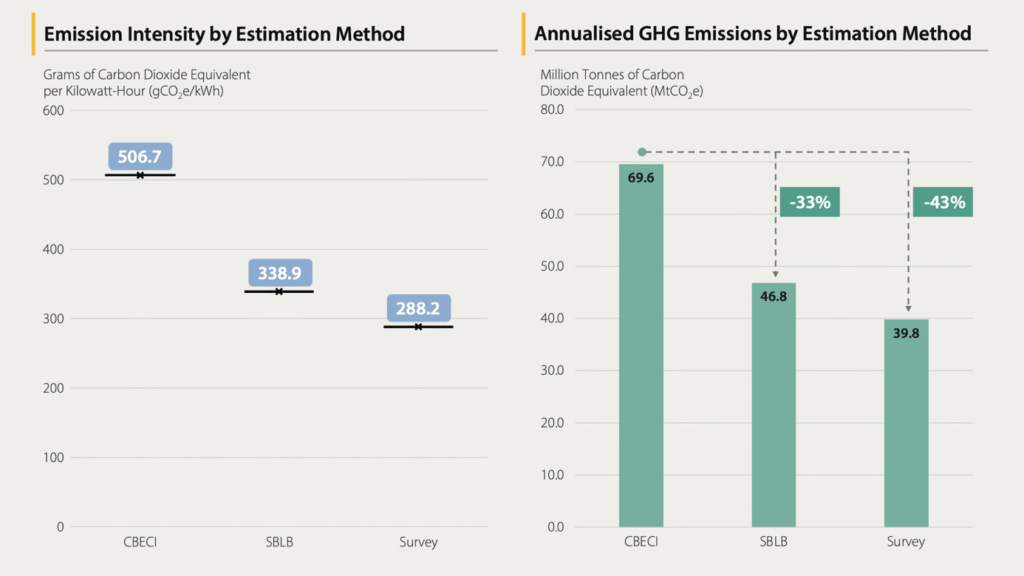

Emissions: A More Accurate Picture

The study estimates annual Bitcoin mining emissions at 39.8 million tonnes of CO₂ equivalent (MtCO₂e), which is just 0.08% of global greenhouse gas emissions. Depending on the assumptions about combustion efficiency for flared gas and the global warming potential (GWP) timeframe, the number could be as low as 32.9 MtCO₂e. Both figures are significantly lower than many previous, more alarmist estimates – underscoring the importance of using up-to-date, granular data and realistic assumptions when evaluating Bitcoin mining’s climate impact.

Beyond the Headline Numbers

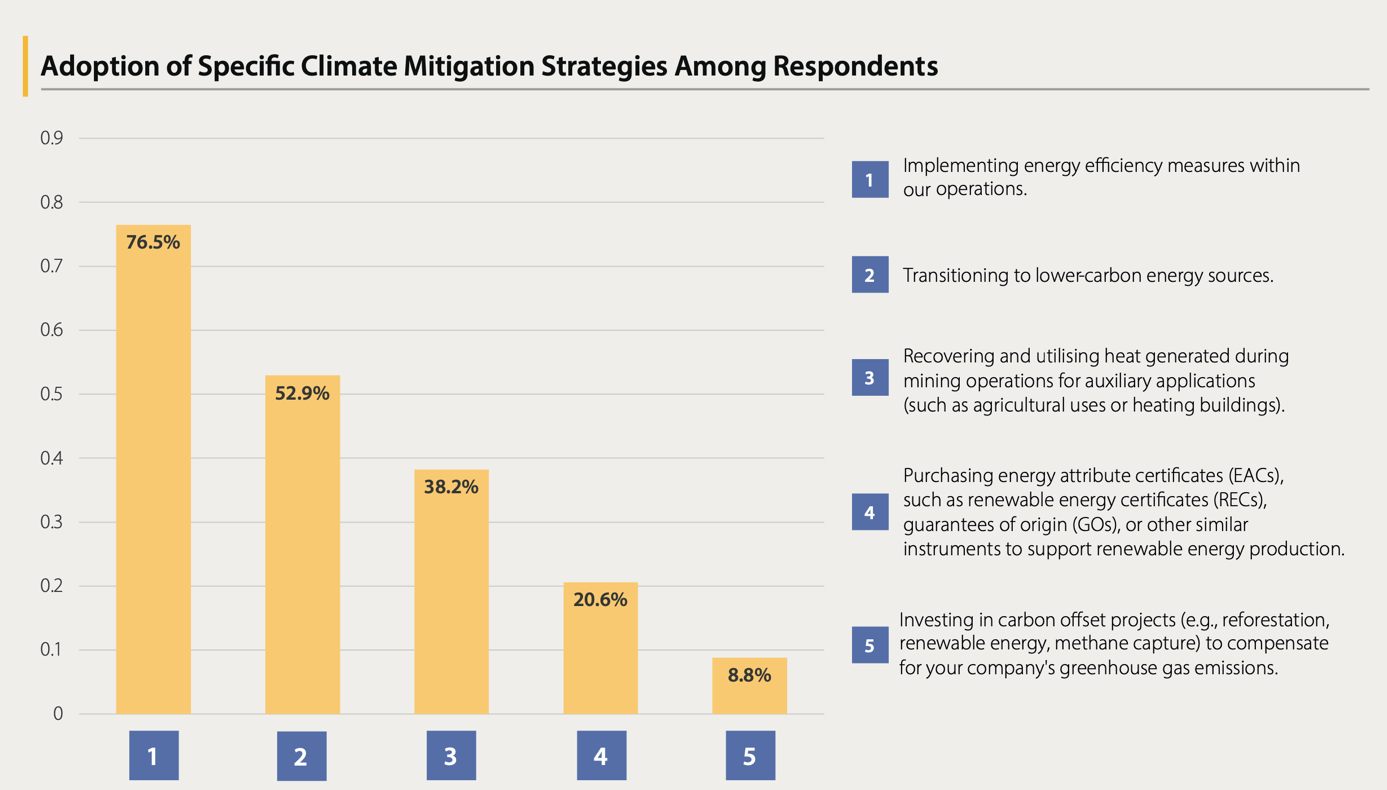

Climate Mitigation and Innovation

Over 70% of miners surveyed report using energy efficiency measures, cleaner energy, or waste heat recovery. Notably, survey data reveals that 6.8% of miners currently use flared gas, accounting for 3.3% of the industry’s total energy mix, demonstrating that this approach has already transitioned from theoretical to practical application.

Grid Flexibility

Bitcoin miners increasingly help balance energy grids; in 2023, 57% curtailed load, providing 888 GWh of demand response. This flexibility helps balance electricity supply and demand, making grids more resilient – especially as renewable penetration increases.

E-Waste and Circularity

Concerns about e-waste in Bitcoin mining are not unfounded, but the data shows a positive trend: nearly 87% of retired mining hardware is reused or recycled, keeping annual e-waste at just 2.3 kilotonnes. These findings – significantly lower than e-waste estimates suggested in peer-reviewed literature – highlight the importance of basing assessments on robust, real-world data.

Mining as Energy Innovation

Bitcoin miners are emerging as energy innovators by leveraging their unique flexibility as energy buyers. About 8.1% of mining power is now off-grid, while others act as “buyers of last resort” for surplus electricity – meaning they can absorb surplus electricity that would otherwise go unused or be wasted. This positioning allows miners to:

- Help balance grids by curtailing load during peak demand

- Reduce methane emissions by using flared gas

- Utilize otherwise wasted or stranded energy, including remote hydropower, excess wind and solar, and gas flaring sites

These strategies don’t just make mining more sustainable – they can have positive spillover effects for the broader energy system, supporting the integration of renewables and enhancing grid resilience.

Together, these operational shifts reflect a broader move toward sustainability. As miners adopt cleaner energy sources, improve efficiency, and innovate in hardware reuse, the industry’s environmental footprint shrinks while its value to the energy system grows.

Future Projections

The report’s respondents expect continued growth in the sector, with further acceleration in decarbonization and expanded grid services. As mining becomes more integrated with energy markets, its potential to act as a flexible, demand-responsive load will only increase.

Data Uncertainties: Room for Improvement – and a Strong U.S. Focus

- Survey coverage/self-reporting: Based on 49 firms, covering 48% of global hashrate. The other 52% not directly captured. Data is self-reported, so some risk of bias or selective reporting.

- S. dominance: 75% of surveyed mining activity is U.S.-based (so results may over-represent North American practices). Reflects America’s current leadership in the sector, but means results are heavily weighted toward North American practices.

- What this means: Prevalence of sustainable energy, grid flexibility, and other positive practices may be overstated or understated compared to regions like Asia, Central Asia, or Africa, where energy sources and regulations differ.

The Cambridge researchers recognise these limitations and advocate for more global, diverse data in future editions to provide a more comprehensive picture.

However, these limitations do not diminish the report’s significance – they offer a roadmap for future research and a foundation for a more comprehensive global understanding.

What This Means for Policy and Investment

The Cambridge Digital Mining Industry Report 2025 marks an important step forward for transparency and evidence-based dialogue in the Bitcoin sector.

For policymakers, this data indicates that energy-efficient Bitcoin mining can complement rather than compete with climate goals, potentially informing regulations that promote sustainable energy partnerships rather than outright restrictions.

For investors, the report shows that Bitcoin’s decarbonization is opening ESG-aligned opportunities and meeting rising demand. The data supports not just ESG compliance and the notion that Bitcoin can have positive ESG effects, thanks to cleaner energy, grid services, and methane reduction.

This isn’t just theory – it’s already happening.

By providing robust primary data and academic validation, the report challenges outdated narratives and highlights the sector’s rapid evolution toward sustainability. While challenges remain – especially regarding data coverage, supply chain emissions, and regional disparities – the report demonstrates that Bitcoin mining is evolving faster than almost any other industry in terms of emissions reduction and operational innovation.

For anyone interested in Bitcoin, energy, and sustainability, this report is essential reading. It clearly demonstrates that Bitcoin mining is marked by continuous innovation and real progress, rather than stagnant problems.

Reference

Neumueller, A., Pieters, G., Mohaddes, K., Rousseau, V., & Zhang, B. (2025). Cambridge Digital Mining Industry Report. University of Cambridge.

For a deeper dive, you can read the full report here (PDF).

Ready to transform your mining strategy?

Our innovative approach to earning Bitcoin provides optimized exposure to mining returns without the traditional operational headaches.

Disclaimers

Past behaviour does not guarantee future results. The analysis presented in this document is based on historical data and projections that may not accurately predict future outcomes. Bitcoin mining and investment involve substantial risk of loss and are not suitable for all investors. The value of Bitcoin can be highly volatile, and investors should carefully consider their objectives, risk tolerance, and ability to bear losses before subscribing.

Mining returns are subject to numerous factors beyond our control, including but not limited to: changes in Bitcoin network difficulty, hardware efficiency, Bitcoin market prices, regulatory changes, and technological developments. Projected returns are estimates only and may differ materially from actual results.

This document is for informational purposes only and should not be considered as investment advice or a recommendation to buy, sell, or hold any investment. Investors should conduct their own research and consult with qualified financial advisors before making investment decisions.

Tax implications of mining operations and cryptocurrency transactions vary by jurisdiction. Investors should seek professional tax advice for their specific situation.